If we told you that your cost price was potentially a huge 77 cpg different from what you thought it was, how would that impact your fuel pricing decisions?

The method used to allocate a cost of product can have a severe impact on the decisions fuel marketers make. 77 cpg was indeed the difference between the replacement cost and the blended cost of product currently in the tanks for one of our customers a couple of weeks ago.

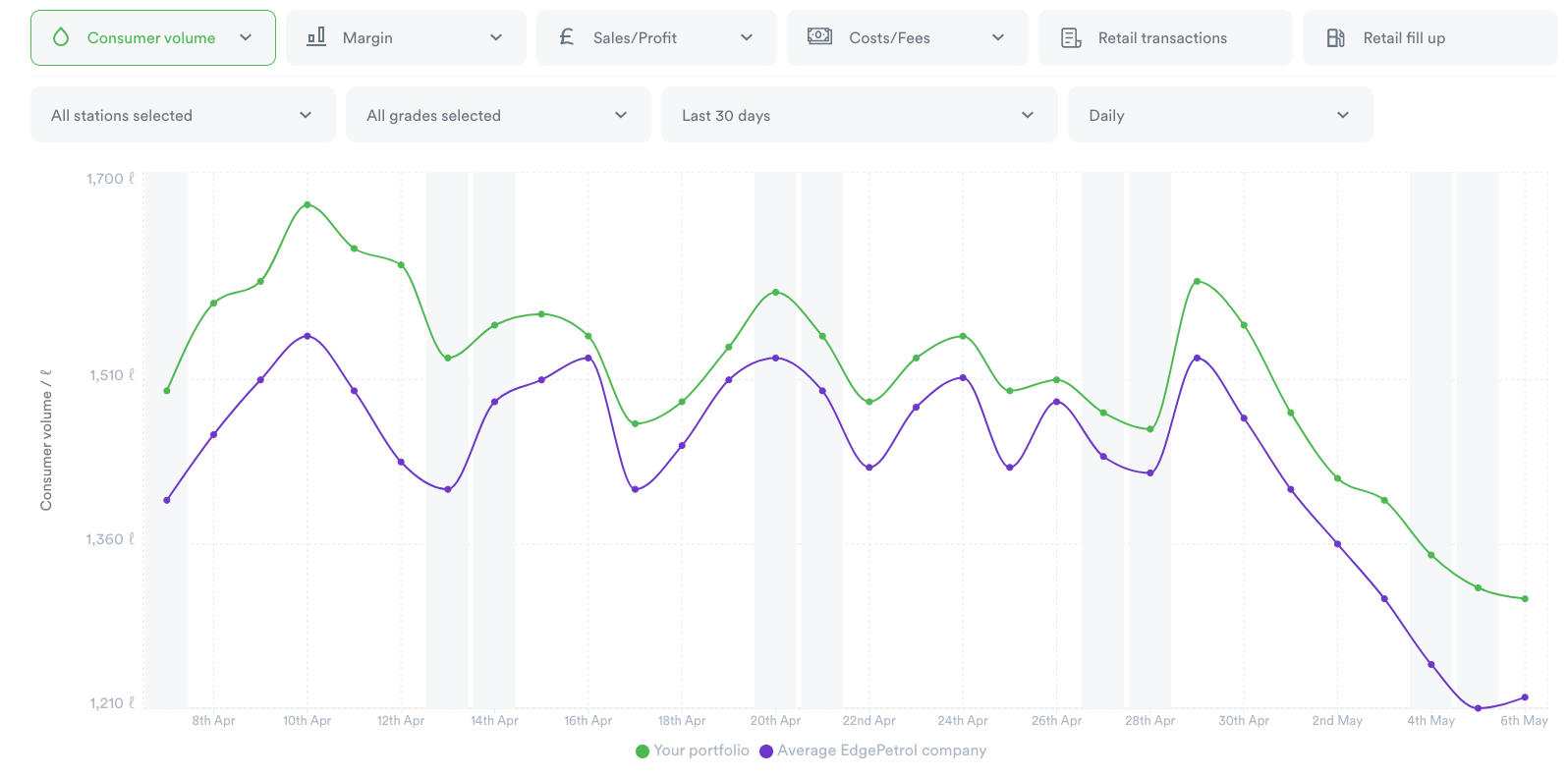

The market is volatile and this doesn’t look like changing anytime soon. The volume game is on hold as demand drops.

Maintaining your desired margin, big or small, is more important than ever.

Below we have outlined four methods of costing product:

Replacement Cost

Essentially costing all the fuel in your tank against today’s price on the basis that you are going to have to replace that fuel anyway. And this has some benefits; not only is it the easiest number to capture but it allows you to keep a close eye on where the market is heading.

The problem is that by not taking into account the cost of deliveries that came yesterday or before, you could be getting a totally different margin than the one you expect.

Last delivery cost

In this method you are always using the cost of your last delivery to price fuel. Whilst this is a bit more work (often keeping track on a spreadsheet) and is usually only possible for smaller estates, it probably makes more sense that the replacement cost option.

Whilst less of an issue than replacement cost, you will rarely have only one delivery worth of fuel sitting in your tanks (especially when the market is cheap). This means you are still not taking into account the oldest fuel sitting there, that you are selling at a potentially higher or lower cost. You can get around this by using FIFO.

FIFO

FIFO (first-in-first-out) is a great method as it will typically match your accounting practices. It is tracking what fuel comes in and what is leaving, applying the volume leaving to the oldest delivery. This means you can see, for example (for simplicity we’ll use ppl), “We have 800 gallons at 89 cpg and 1200 gallons at 92 cpg . We can hold our price for 800 gallons and then need to change.”

It is probably only possible to track FIFO at the end of each day with spreadsheets, although pricing software such as that offered by PDI are able to provide real-time FIFO view.

This method also leads to big jumps in cost prices and margin as it is what we refer to as ‘stepped’. This means that whilst you are able to make sure your margin is as desired your pole price may be taking sharp, large moves which can be irritating or confusing to consumers.

Blended cost

This may come across like we are plugging EdgePetrol, but hey, we are. As the market has become volatile, our usage jumped significantly as marketers tried to understand their cost positions.

By applying the cost price to each delivery that lands, the cost prices weight and blend based on the fuel currently in the tanks. When fuel is removed by customers this is removed from the oldest delivery and re-weighted for each transaction.

This means you get a steady curve of cost prices and allows you to make the pricing decision correctly at the exact right time.

Using this methodology has allowed EdgePetrol users to maintain a steady margin and stay profitable in these uncertain times.

If you’d like to find out more about how EdgePetrol can help you optimize your pricing, book a demo with us here.