Everyone talks about how the market is changing, but a lot of this change has already happened.

In September 2021 we saw the impact of supply chain issues, with tank volumes reducing to an average of 17% (usually between 35% and 40%) in independent forecourts across the country. This is impacting flexibility in procurement and in some cases the ability for retailers to drive profits when ordering tankers.

Market consolidation is also creating a more powerful competitor. With the Top 10 Independents now owning over 24% of UK sites, bigger players have better access to financing, more purchasing power, better technology and better branding opportunities across their sites. This makes it increasingly difficult to compete with them.

Consumer habits have also changed. Sure, the pandemic has played into this, but consumers were already less focused on price. A study by Linworks told us that 40% of consumers will sacrifice cost savings for convenience.

Cost prices have been and continue to be volatile. At the time of writing Brent Crude is trading at over $90 a barrel and retailers are taking margin hits at the pump. As supply chain costs continue to rise, this could have a continued impact at the pump where retailers have less control over their margins and their subsequent profits.

Most importantly, volumes themselves are under attack from alternative fuels. Retailers will need to find a way to make more per litre to get the same result, whether that is through shop offers, better facilities, pricing strategies or EV itself.

As with any change there are winners and losers and this has left us with three types of retailer in the market. Those who want to leave the market are Exiters. Many exiters have already left or are looking to leave the market to take advantage of large EBITDA multiples instead of making the necessary changes to compete in this new world.

Existers are those who aren’t looking to leave the market, but are also not looking to make a change. Typically late adopters, Existers have survived by following the competition on price and keeping things simple. This may have worked in the past, but the industry is powering ahead and those who are not looking to change will be left behind.

Finally, we have Excellers. These retailers recognise the changes happening around them and are looking to optimise all parts of their sites. Most are investing to bulletproof their assets for the next 10-15 years of trading. They also know that this type of investment is only justified with a decent payback and as a result they have a keen eye on optimising everything, particularly fuel prices.

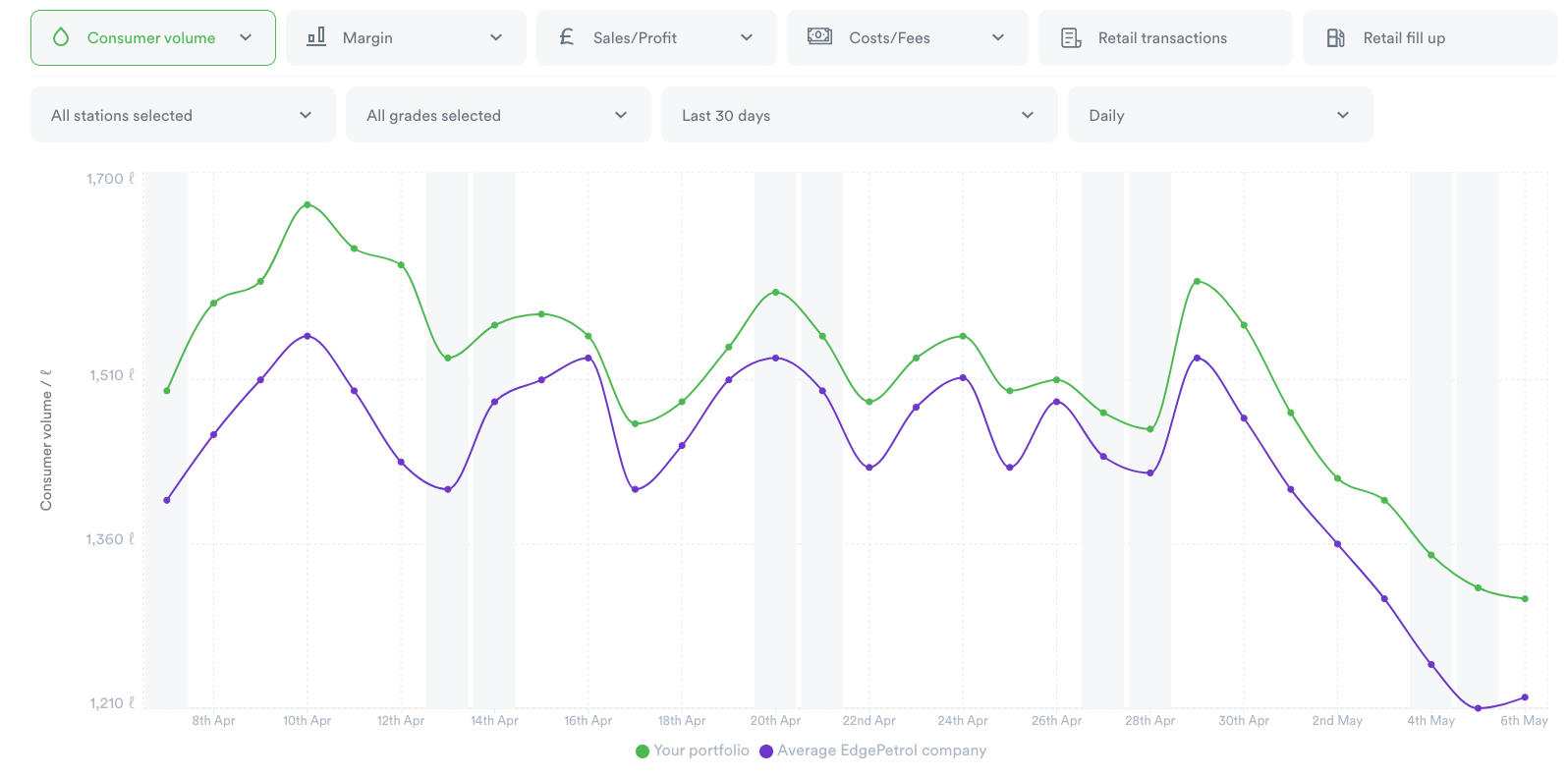

The key problem these Excellers face when it comes to optimising pricing is access to timely and accurate data around the five pricing pillars; volume, margins, profit, competition, and execution. Those who are still using replacement cost and next-day (or worse) volume reports are beholden to the competition, meaning there is money being left on the table that doesn’t need to be.

Using real-time data in EdgePetrol has enabled them to test new pricing strategies, that grew margins by well over 1 cpg . Weighted-and-blended margins show the true cost of product in tanks, allowing retailers to get nearer to the competition when they can afford to or holding when they cannot. This is driving profit increases upwards of 18%.

As the market evolves and more profit is needed to be generated from each litre, it is these Excellers that will be the victors. If you’re not making changes on your sites, now might be the right time to exit.

Click here to book a demo today to find out how EdgePetrol can help your business or call +1 512 265-8504-