Pelco and Supermac’s are amongst the retailers embracing new technologies in the fuel market.

Ireland is leaps and bounds ahead in convenience retailing. When it comes to shop offers, facilities and food-to-go, retailers from the UK, USA and the rest of the world sit up and take note.

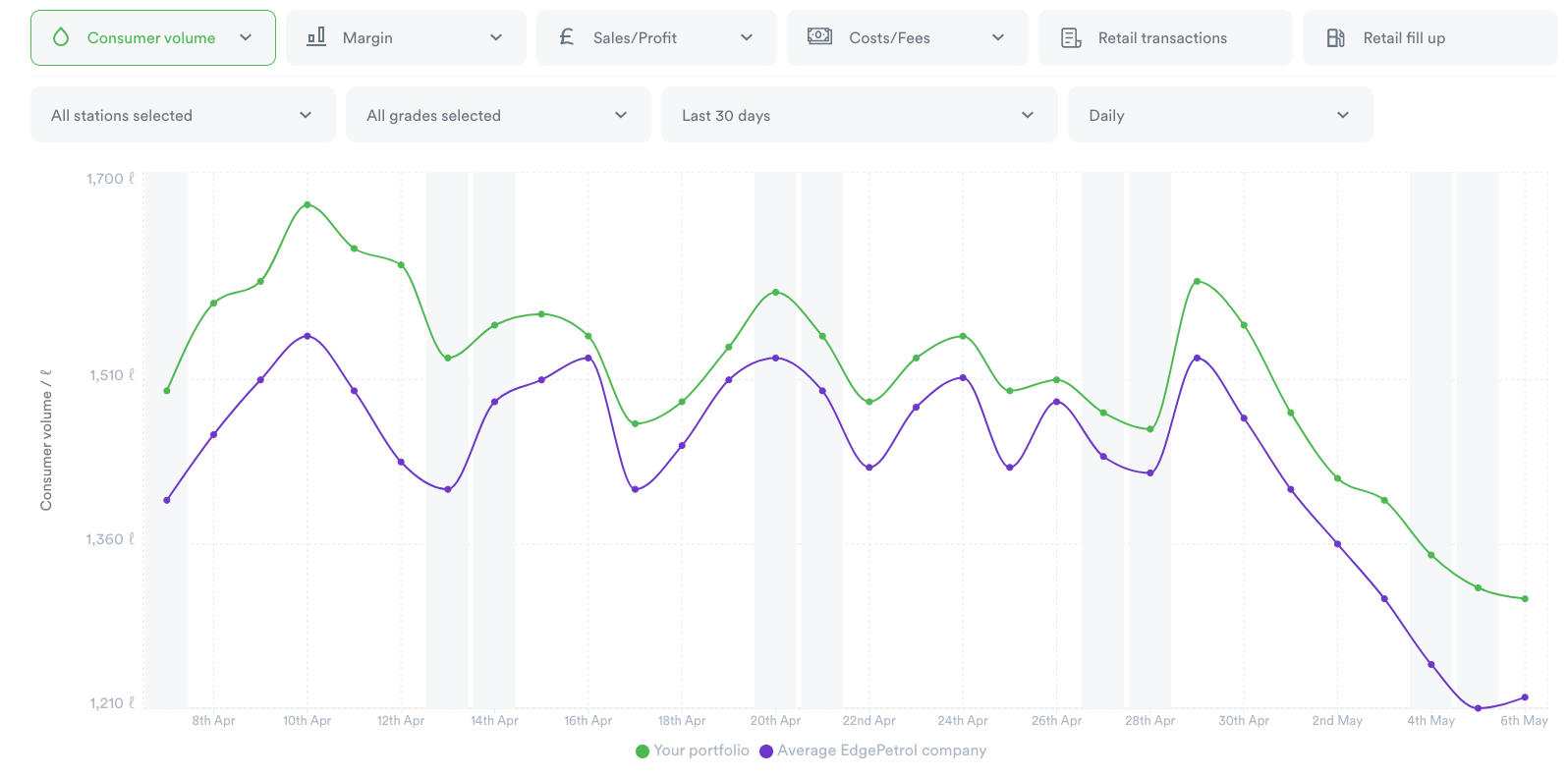

In spite of this, the Irish forecourt market is facing big challenges. Staff shortages are commonplace and volumes have not recovered at the same rate as- for example- the UK and the USA, having a material impact on in-store sales. Where they have recovered, they have often been sporadic and unpredictable.

Fluctuating oil prices have made keeping on top of fuel margins more challenging, adding difficulty to finding the optimal pricing strategies that provide necessary profit without sacrificing volume to the competition.

To overcome these challenges, many retailers are turning more and more to their data to help them make decisions and this is giving them a huge competitive advantage in tough market conditions.

Traditionally, data used to decide on fuel prices has sat on one or more spreadsheets, pulling information from multiple sources and only providing a true picture of the situation after the fact, when it is too late to have an impact. This has all changed with the introduction of live, accurate data available at the click of a button through EdgePetrol’s pricing software.

Pelco- operator of thirteen Texaco and one Top-branded forecourts- are one of the many retailers benefiting from real-time insight on fuel volume, margin and profit. They were able to spot how their pricing versus their competition was impacting their site’s performance.

Like most retailers, they were using replacement cost (the cost of taking a delivery today) to work out their margins. They realised that this wasn’t accounting for previous deliveries that had arrived at different cost prices and wasn’t giving a true reflection of the cost of the fuel currently in their tanks. It was impossible to know whether they really reached their number until it was too late to make a change.

Barry Quigley, Chief Operations Officer of Pelco was well aware of the challenges of using spreadsheets to price fuel. “Before using EdgePetrol, we were shooting in the dark.” He said.

EdgePetrol connects directly to the tanks and daily/weekly cost prices to weight and blend new deliveries with existing fuel, providing an accurate margin as well as real-time volume on a grade, site and portfolio basis. With this new insight, retailers know whether they can get closer to their competition or whether they need to increase their price to hit their profit numbers.

“Previously, we wouldn’t have confidence in the tools we had to test site sensitivity. We’ve seen shops performing well and are capturing higher margins. We are a growing business and to continue to grow in these times you need to find a different way of doing things.”

Combined with EdgePetrol’s volume forecasting algorithm to improve procurement, Pelco were able to increase their margins by over 1cpl. This is common across retailers who are making this change to the way they operate.

Other retailers have seen similar results, citing 2cpl margin increases, 35% weekend volume increases and 18% increases as a result of access to live and accurate data.

Supermac’s- operator of 9 forecourts- is also benefiting from the move away from spreadsheets. With a huge reduction in time spent managing them, they have been able to focus on using access to live and accurate data to better manage their business. CFO Dermot O’Connell explains “Time is now spent on designing strategies that help us manage our gross and net margin better.”

There are also new pricing strategies entering the market that were not possible before. Fluctuating the spread between regular and premium grade fuel has been particularly popular. One single site retailer added 23% in premium grade profit that was then used to subsidise their regular grade and push for more volume. Without the live insight into margin and volumes, this wouldn’t be possible.

The biggest players in the market have been armed with clever data sets for some time, but the real-time element of pricing software is providing a unique advantage to those willing to embrace it.

If you’re not getting on top of your data, there is a chance you might be left behind.

Ask yourself:

- Am I making the right pricing decisions?

- Have I got the right data in front of me to make these decisions?

- Am I taking the opportunity to employ best practice strategies for my sites?