Industry consolidation shows no signs of slowing down.

With each passing week, it seems the big brands continue to get bigger. It’s easy to see why this is concerning to small and midsize operators. It can also be demoralizing as once-competitive peers essentially throw in the towel and exit the business.

But the truth is that small operators often have advantages of their own—especially those with unique, hyper-local offers. The problem is they don’t have the luxury of leaving money on the table by relying on outdated business strategies. Every dollar counts. From our vantage point, fuel pricing is one area where changes are needed.

Let’s take a closer look:

How the Industry is Changing

Mergers and acquisitions are all the talk right now. It’s fair to suggest that the past decade of M&A could be characterized as a “whirlwind of transaction and aggressive consolidation,” as was recently mentioned by Ken Shriber, managing director of Petroleum Equity Group.

But the industry is changing in ways beyond just consolidation. As summarized in a recent article, the leading fuel and convenience retailers are gravitating towards three distinct business models: merchant canopies, quick-service restaurants (QSRs), and, of course, consolidators.

In the case of the first two, the strength of their stores enables them to sell fuel at prices that may be unsustainable for their competitors. Some merchant canopies and QSRs are likely positioned with negative break-evens and able to use fuel as a loss-leader.

The consolidators are in a different position. Although competitive on fuel pricing due to their ability to negotiate favorable supply agreements, they’re effectively taking what many would think of as a “traditional” convenience store and operating it at scale. Their inside sales are more dependent upon the traffic generated by fuel sales than their QSR or merchant canopy competitors.

This model has held up over the past year as more brands have chosen sides. While Murphy USA has long-stated a resistance to M&A activity, their acquisition of QuickChek may be an indicator that the company is gravitating towards the QSR corner by purchasing their know-how in foodservice. Speedway also seems to have shifted towards the consolidator corner in their proposed acquisition by 7-Eleven.

Smaller operators often feel threatened by these shifts and may feel that the only way to compete is to sacrifice their fuel margins. The good news is that’s not necessarily true.

Why Racing to the Bottom is a Losing Strategy

Many operators sell themselves short by instinctively pricing against the lowest brands in their markets. This is problematic for three reasons.

First, it’s an outdated strategy based on a misunderstanding of consumer behavior. We all know that customers want a fair price on fuel and nobody wants to overpay for a commodity. But the decades-long belief that consumers are hyper-focused on price—and willing to chase savings of a few cents on a gallon of gas—is not supported by recent data.

Consider the NACS Consumer Fuels Survey. In 2015, 71% of respondents said price was the most important factor in deciding where to purchase fuel. By 2020, that number had dropped to 58%. There’s also reason to suspect that these numbers are inflated to begin with since respondents are provided with limited options to choose from. The consumer journey is more multifaceted than surveys are often able to capture.

Second, a race to the bottom on price ignores why consumers often choose to shop at smaller retailers. Many of these brands are relevant to their local communities in ways that their larger competitors are not. Some brands have been around for more than fifty years, others have foodservice programs that speak to cultural and regional flavor profiles, and some may be known for their fantastic customer service or clean restrooms. Many of their customers may be visiting them for reasons that have nothing to do with fuel price.

Finally—and most importantly—this pricing strategy often leaves money on the table. Perhaps a store is conveniently located on a popular work commute. In that case, lowering prices may lead to a small increase in volume but a significant decrease in revenue.

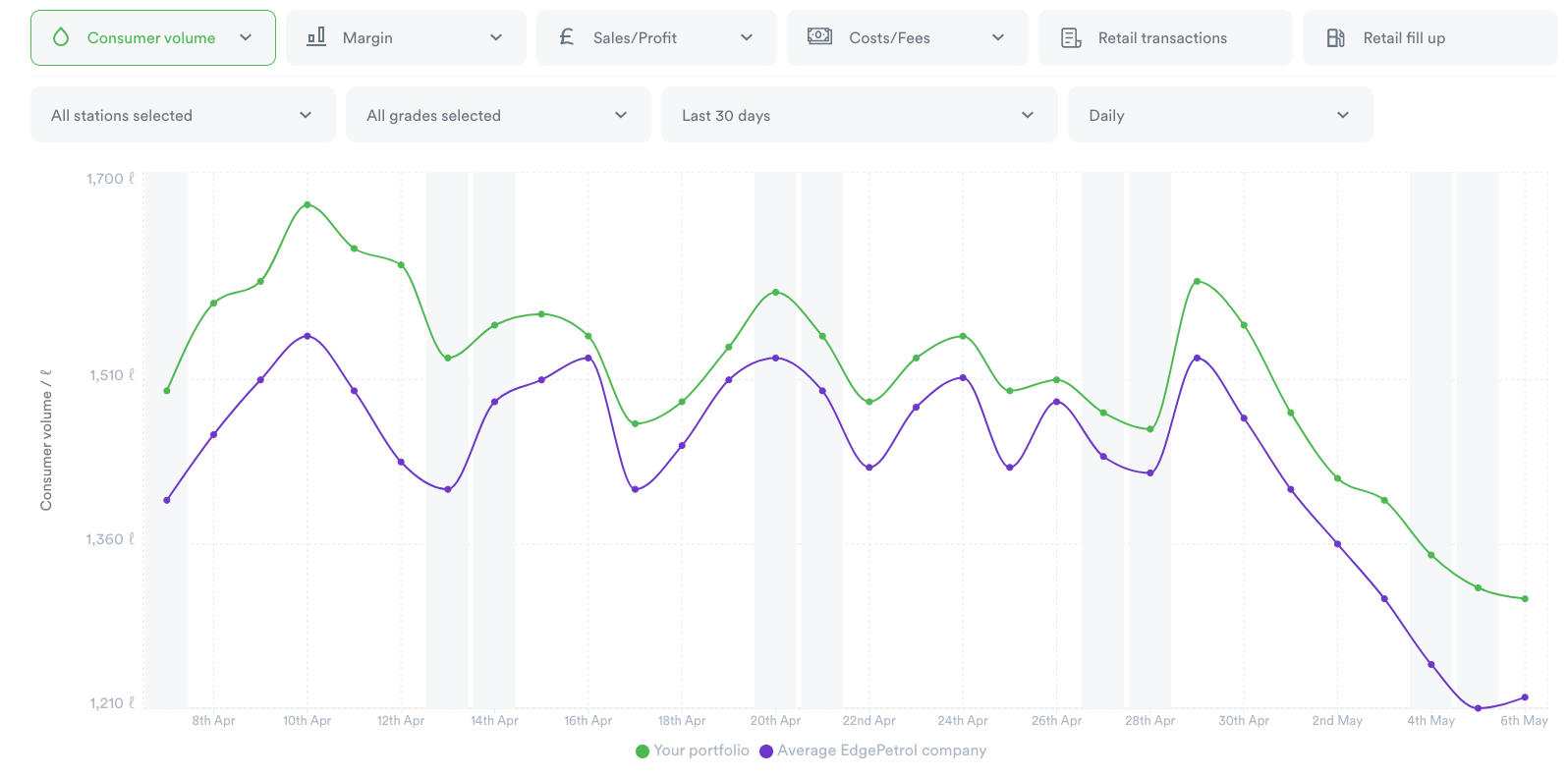

Rather than giving away margins in the hope that it will drive volume, we help retailers access their data and gain a more comprehensive understanding of their business. Doing so enables them to deploy a more sophisticated pricing strategy and make every gallon count.