We’re always hearing from retailers that volatile market conditions are returning and that with escalating operational costs, being on top of their own data is more important than ever.

But in order to complete the picture, market data is equally as important.

Even with access to live data, fuel retailers are often left wondering whether it is their decisions or the market that is impacting their results.. This has created a pressing need for tools that provide a broader context, helping fuel retailers make even more informed, strategic decisions.

This is why we built EdgeBenchmarking.

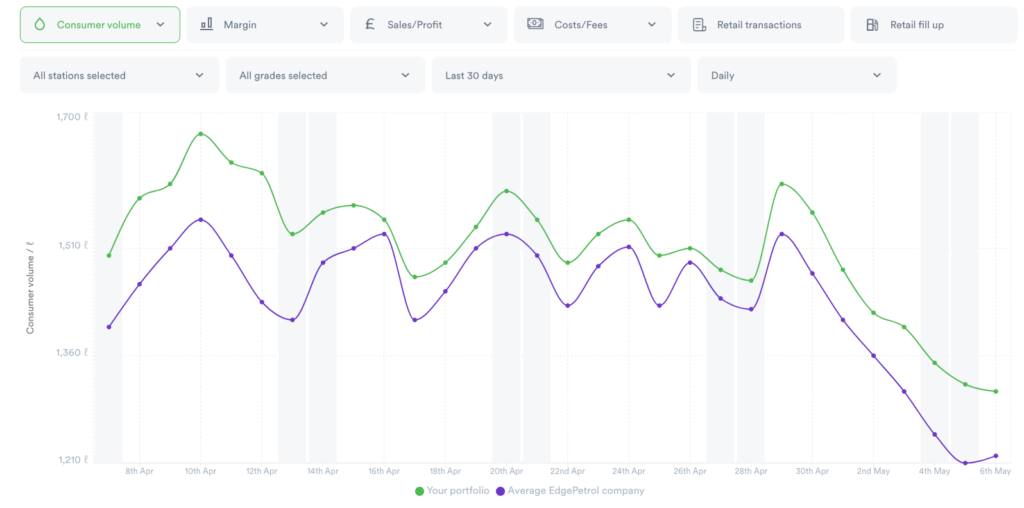

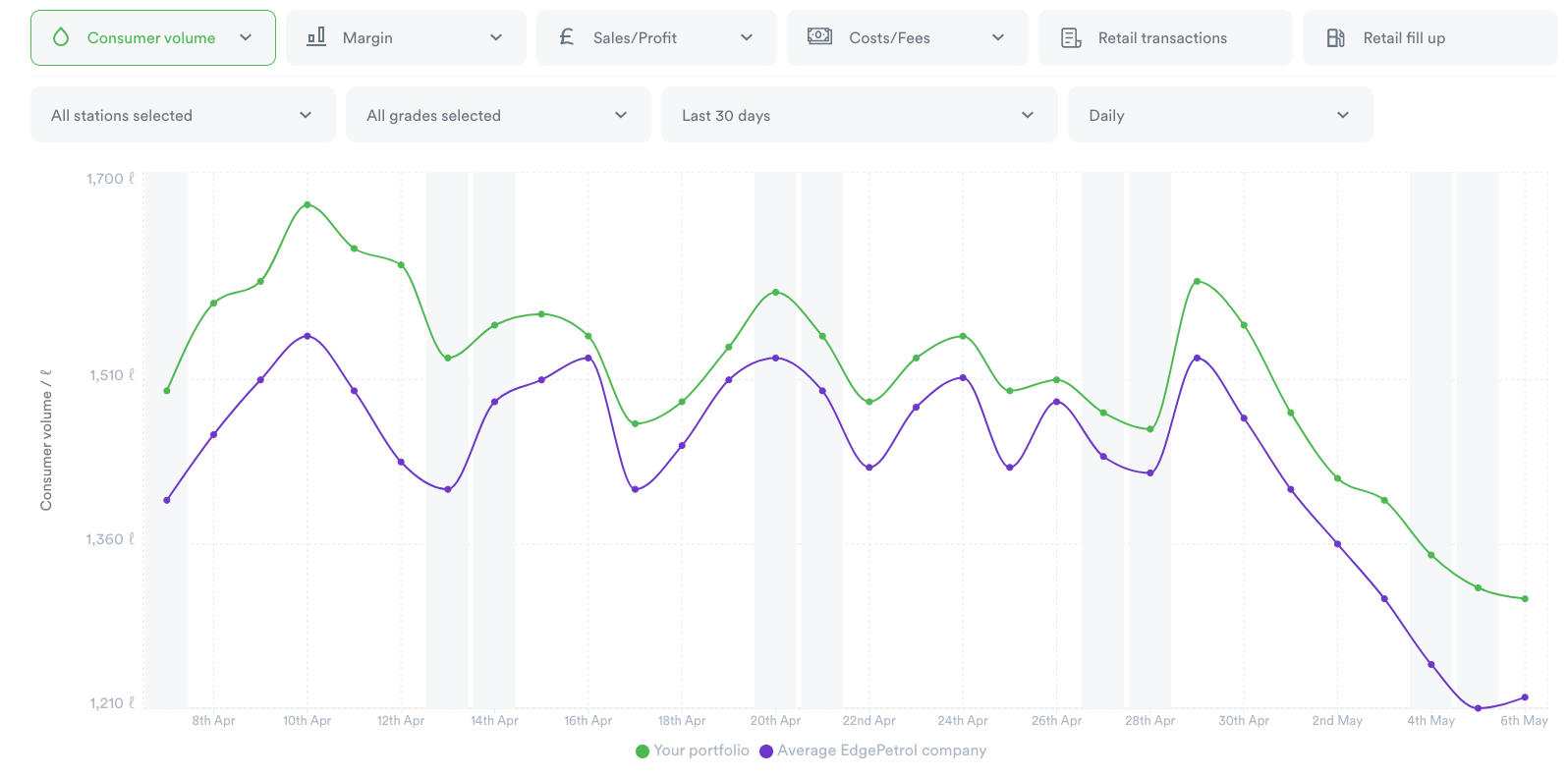

EdgeBenchmarking equips fuel retailers with an easily consumable visual comparison of site performance against broader market dynamics. It provides a clear comparative analysis of new key performance metrics like Consumer Volume (net of fuel card and bunkering), and old favourites such as gross and net margins.

By offering real-time visual representations of market performance alongside individual site data, retailers are aided in understanding not just how they are performing in isolation but in relation to the entire market. Such insights are crucial for validating pricing strategies and confirming the efficacy of operational decisions.

Initial feedback from EdgeBenchmarking users underscores its value. Goran Raven (Ravens Budgens) shared, “This prevents me from making mistakes I might have made otherwise,” highlighting how the new product aids in avoiding costly missteps. Manoj Tandon of Park Garage Group said it provides “Clarity in mind when you don’t know what others are thinking,”

Some retailers have also struggled from being able to explain to non-fuel stakeholders why their results can vary so much compared to the shop. EdgeBenchmarking crafts these compelling narratives for stakeholders. If a site is down on volume or margin, but outperforming the market, the decision making is still validated.

This also prevents hasty decisions that may not be warranted by broader market conditions. Fuel retailers can see at a glance whether a dip in performance is a site-specific issue or part of a wider industry trend, thus preventing unnecessary alterations to strategies that are actually performing well.

Looking forward, EdgeBenchmarking is set to play a pivotal role in the ongoing transformation of the fuel retail industry. As market conditions continue to evolve, having access to a product that offers both detailed insights and a broad market overview is invaluable. Retailers can adapt more swiftly and effectively, ensuring their strategies are both proactive and informed by the most relevant and current data.

Get in touch to find out how EdgeBenchmarking can help your business.