We’ve all heard it. Data is the new oil.

And all of you reading this will have had exposure to data in the fuel industry.

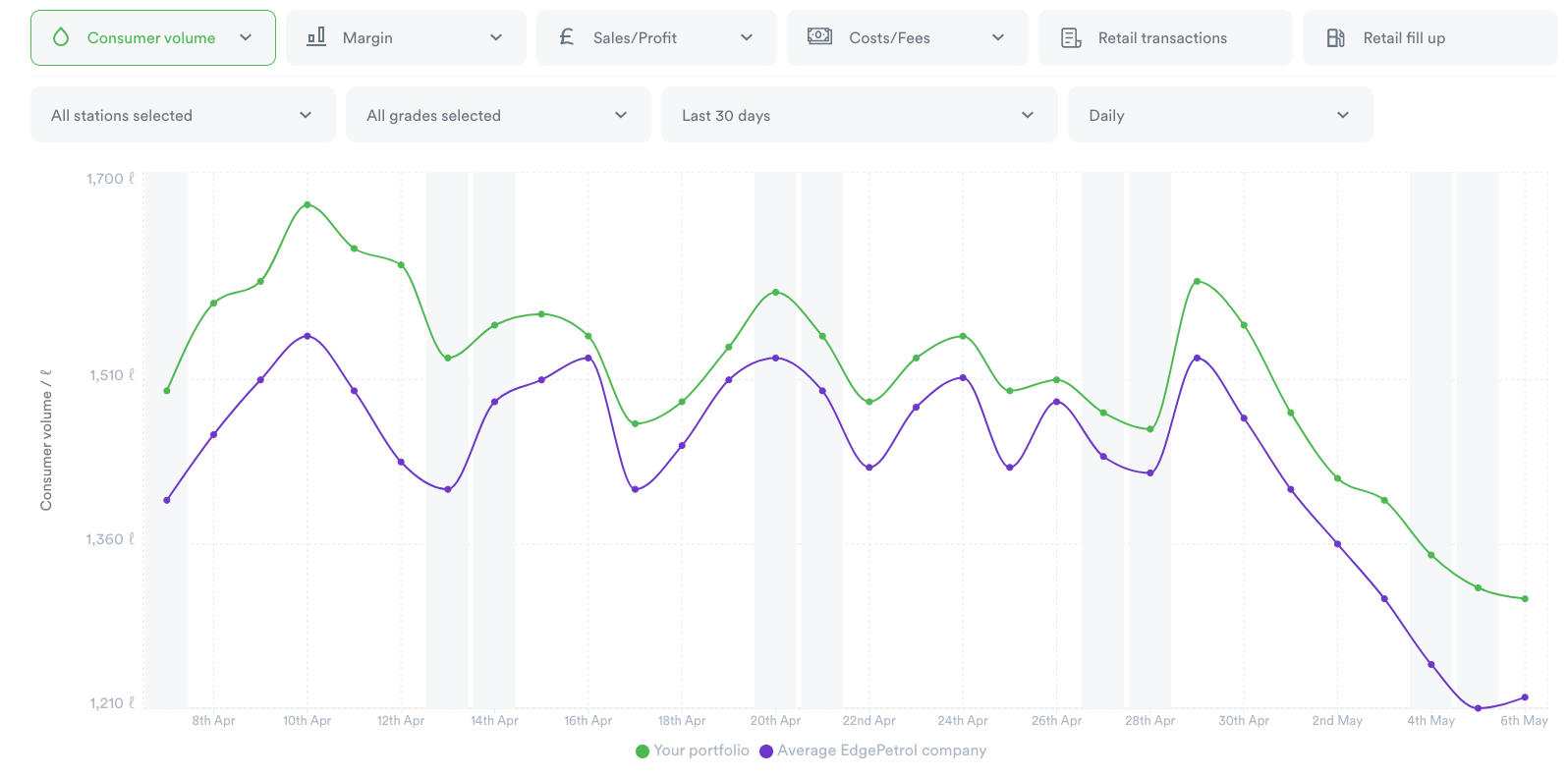

But the truth is, having data is not useful. Without creating the right insight, it can even be detrimental.

So how do you know if you are getting it right? We’ve outlined three key questions that can help you assess your pricing insight capabilities:

1. How much manual entry is involved?

Desired answer: “None”

Spreadsheets are over 30 years old. That doesn’t make them bad, but it does make them very manual. They are subject to human error and the data is usually static.

If you are still manually entering data, the chances are the insight you are getting out of them will not allow you to optimize your stations performance.

2. When do I receive my insight?

Desired answer: “Now”

Ever looked at your end of month results and been disappointed? Ever wished you could go back and change something to produce a better result?

There is a lot to be said for looking at insight after the facts, but understanding the situation at the earliest possible moment will eliminate those regrets.

3. What cost price model am I using?

Desired answer: “One that works for my business.”

As a business that provides weighted and blended margin to customers in real-time, you know our opinion on this. But there is more than one way to skin a cat. We’ve written about cost price models along with the benefits and pitfalls of each, but what we’re saying here is to think about whether your current model really works for your strategy. If margin comes into your thinking at all, is costing all your product at today’s price going to give you the best insight to get your desired results.