About Whatley Oil

Whatley Oil is a leading fuel retailer operating multiple high-volume stations across the Southeast United States. Renowned for its dedication to quality fuel services and strategic growth, Whatley Oil has expanded its operations to include both company-owned sites and wholesale distribution.

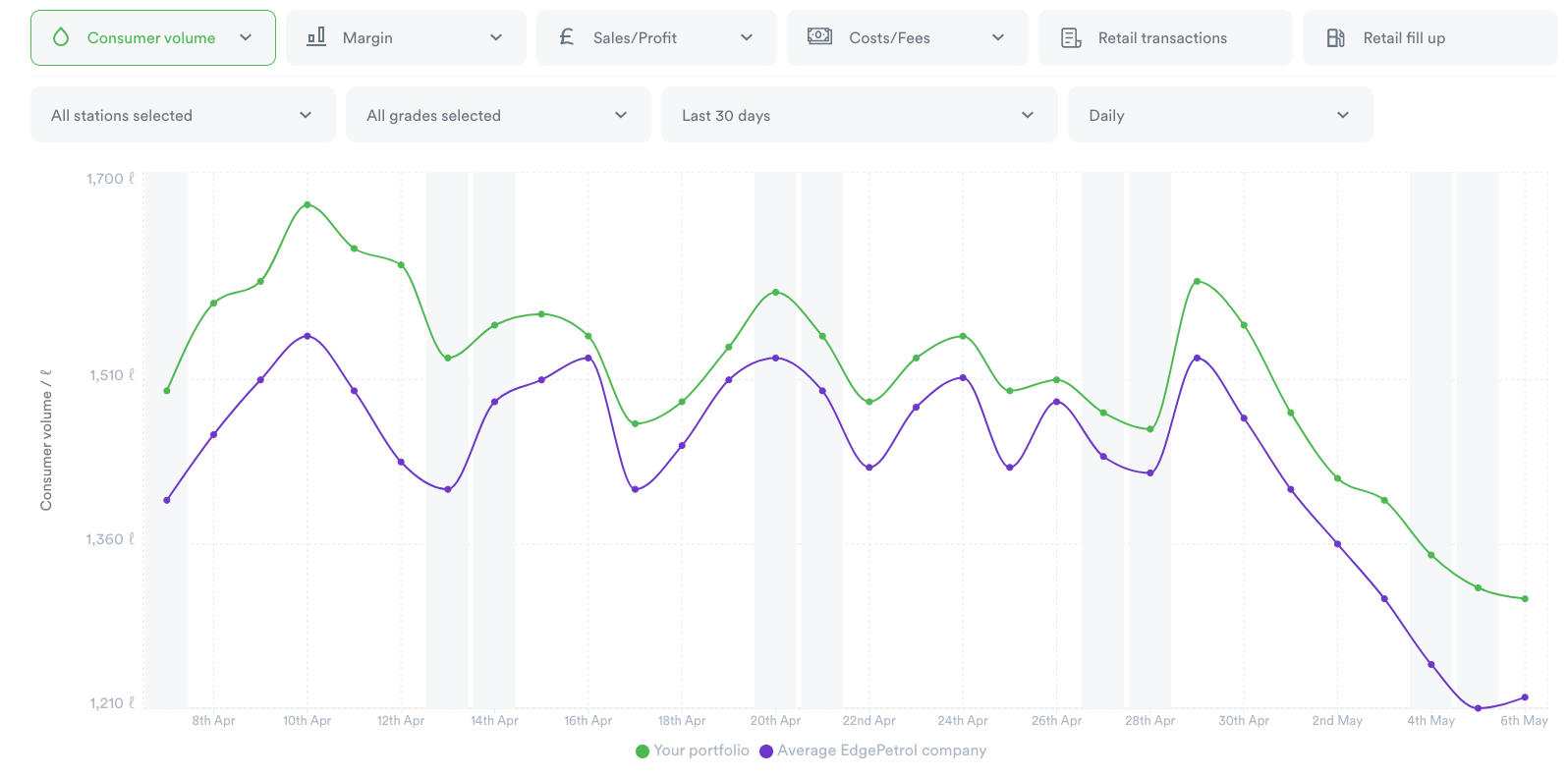

In today’s competitive market, Whatley Oil leverages EdgePetrol to drive profitability while maintaining competitive pricing. With immediate access to real-time pricing, volume, and margin metrics, Whatley Oil’s team can make informed, data-driven decisions across all locations. This capability enables them to swiftly adapt to market changes, ensuring their continued success as both a family business and a fuel industry leader.

Challenge

As the fuel market becomes increasingly volatile, Whatley Oil faced the challenge of balancing competitive pricing with profitability across its high-volume sites. Traditional pricing strategies, while effective in the past, were limited in responding to rapid shifts in market dynamics and competitor activity. With profitability goals at the forefront, Whatley Oil aimed to refine its approach by using real-time data and granular insights to optimize pricing across its portfolio.

Solution

Using EdgePetrol, Whatley Oil gained access to a range of features tailored for data-driven decision-making. Enabling Whatley Oil’s Director of Retail Operations, Slaton Whatley, to explore new pricing strategies and tailor adjustments by specific locations.

By applying these insights, Whatley Oil could:

Refine Competitor-Based Pricing

Slaton leveraged custom period functionality to test various pricing levels against competitors like Circle K. By evaluating price adjustments over different weeks, he could pinpoint how minor price differences impacted both volume and profit.

Implement High-Yield Strategies on Peak Days

Recognizing the potential of peak days, Whatley Oil implemented targeted price increases every Thursday and Friday, holding these prices through the weekend. This tactic capitalized on increased foot traffic, resulting in higher profits without significantly impacting fuel volume.

Optimize Premium and Diesel Pricing

Using EdgePetrol, Whatley Oil analyzed the margins of premium fuel grades across high-traffic sites, identifying trends and opportunities to increase spreads on less price-sensitive fuel types. This nuanced approach allowed Whatley Oil to unlock additional revenue across grades.

Adapt Quickly to Market Disruptions

With access to real-time data, Whatley Oil could proactively manage prices based on cost fluctuations and external events, like seasonal demand changes or hurricanes. The ability to adapt instantly to market shifts has provided a significant competitive advantage.

Results

Since using EdgePetrol, Whatley Oil has seen a 24% increase in gross profit while maintaining steady fuel volumes. The implementation of custom pricing strategies has allowed Whatley Oil to exceed profitability targets across its three highest-volume sites. This refined pricing strategy has translated into an increased gross profit per gallon and a quick return on investment, with projected annual gains well above Whatley Oil’s original expectations.

Conclusion

For Whatley Oil, embracing a data-driven pricing model has transformed its approach to fuel profitability. With EdgePetrol’s insights, Whatley Oil can now make agile, informed pricing decisions tailored to both market conditions and customer behavior . By blending strategic price adjustments with real-time data analysis, Whatley Oil is not only meeting but exceeding its financial goals in a competitive landscape.

Use real-time data to stay ahead in a competitive market. Get in touch to see how EdgePetrol can support your business.