Fuel retailers can be broken down into three categories:

- Exiters – those looking to sell their stations/business

- Existers – those not looking to make a change at all

- Excellers – those looking to optimise their stations and grow their business

Through conversations with thousands of retailers across the UK, Ireland and the USA, we have learned that every single one is different in some way.

But there are two strong areas of consistency for excellers in particular.

The first is that they recognise the same challenges. Volatile cost prices, unpredictable volumes, aggressive competition, changing consumer habits (not to mention staffing, business rates/tax and more).

How prevalent these issues are for each exceller is different, but for almost all of them they were on their mind in some way, shape or form.

The second is what goes into how they price their fuel. Whilst there may be some variation, an optimised fuel business is looking to drive profits through five core pillars of pricing:

- Volumes

- Margins

- Competition

- Profits

- Execution

So, what do these mean and how can you as a fuel retailer use these pillars to optimise your business?

Volumes

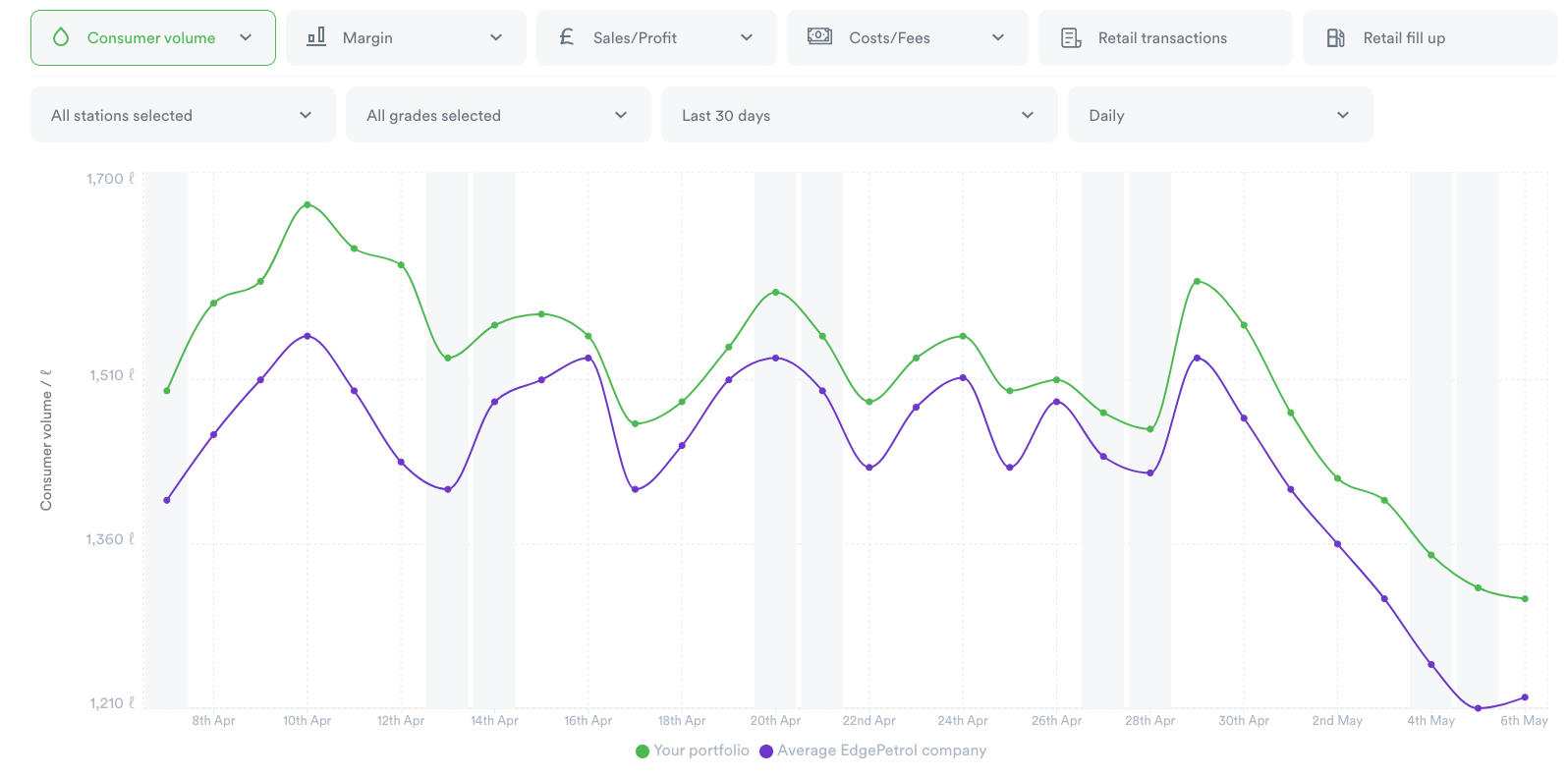

The market is now volume driven. It is widely agreed (and cited by the EIA) that fuel volumes will reduce through to 2050 now, mainly due to the option of alternative fuels. This reduction means that every litre/gallon of fuel you sell needs to create more profit to get the same result.

There are of course lots of ways to drive this outside of pricing, but growing volumes has shifted to growing the right volumes. And these should also be at the right time, buying the right products.

Overall, the link between volumes and competition is reducing as consumer habits continue to change. US studies by NACS show that only 52% of consumers use price as the dominating factor when filling up fuel.

This means you need to find new and better ways to drive volume to your sites and allowing the competition to dictate this simply isn’t the optimal strategy.

For example, one EdgePetrol user had always followed the aggressive competitors near their stations. They moved away from only using their competitors’ prices and started using volumes too. They waited until their volumes were being impacted and this gave them new knowledge of how their stations respond to competitor pricing.

This grew their profits by 18% across a year! Go figure.

Margins

Margin data is traditionally the most under-utilised pillar of pricing due to the restrictions around cost prices. In the ‘before time’ retailers would base their margin on today’s cost price, re-costing all their fuel regardless of deliveries to provide something called replacement cost.

The problem with this method is that old fuel in the tanks was not being accounted for and this led to a falsified margin number. Sure, month end accounts would show the true picture, but by then it was too late to change anything.

These days, by connecting into the PoS, the tanks and a station’s cost prices, EdgePetrol can provide a blended number live. This is providing more options for retailers who are looking to optimise their business.

This means that the number itself is more useful. By knowing a real-time and more accurate cost of product, retailers can either get closer to the competition if their costs are lower or move upwards if they are not getting the margins they desire. Just this golden number is proven to grow profits by over 16% versus using a replacement model.

Competition

Let’s be honest though, competition will always factor into your pricing decisions. How they factor in, however, has changed.

Excellers are reviewing who their competitors are more frequently on a per-site basis and using pricing to test out sensitivity. EdgePetrol’s premium platform, EdgeAnalytics, shows which competitors follow up/down and how quickly they are doing this.

This type of data, combined with volume and pricing is key to building new strategies on regular and premium grade pricing, as well as being more dynamic for weekend discounting and social media volume drives.

Profit

As one EdgePetrol user puts it “Volume is vanity, profit is sanity”.

At the end of the day, how your fuel pricing influences your profit is what really matters. Of course, that isn’t just profit from fuel, and only you’ll know how much you are looking to take as a percentage of your profit across your asset’s offerings (fuel, shop, food, car wash etc.).

What was consistent amongst existers (that don’t want to change anything) we spoke with rather than excellers is that profit from fuel just depended on the competition. A good year was lucky, a bad year was unlucky.

What excellers have done is removed most (but never all!) of the luck from the equation. Or, you could argue that where they have got lucky, they made their own luck by being better placed to take advantage of a particular situation.

Knowing and understanding profit in real-time is key.

This tells you whether you need to push for more margin from fuel or whether you can give back to your customers. On its own, it isn’t that useful for today’s decision making, but combined with the other pillars, it holds up your canopy as you can see what the key drivers are and adjust them accordingly.

Execution

Finally, you’ve made your decision. You’ve sent it to your Station Manager. Month end results come in. Profit is not where you thought it would be. Why?

Unfortunately the Station Manager got held up. Or typed in the wrong number. Or they are a Commission Operator and conveniently ‘forgot’ to make the upwards price move.

A delayed price change at one station can reduce profits by hundreds. A wrong price change can cost thousands. Not having visibility of that change is a high risk strategy.

So, this is leaving excellers with a choice. Invest in the technology that allows for remote price changing or take a hit. You can do this via CAPEX spend and investing in the pole-sign technology needed, or you can use software like EdgePetrol to alert you if price changes haven’t been made (or have been made incorrectly).

Either way, it’s a real shame to make a great decision only to not see it executed.

Are you an exceller?

Take a step back and think about your pricing process and whether you fit into the category of exceller. If you aren’t at least thinking about these five pillars, there is probably money being left on the table.

We have loads of examples of successful pricing strategies implemented by retailers using these pillars. If you add only one of them to your thinking, you could take some of that money off the table too!